Medicare or Medicare Advantage?

Before we explain the differences, it is beneficial to seek the advice of a licensed sales agent, certified to offer Medicare Advantage assistance. Much of the confusion can be avoided by having a thoughtful conversation with a professional. CONTACT US HERE to initiate that conversation.

When you enroll in Medicare for the first time, you’re automatically in the program that’s been in place since 1966. If you prefer to join a Medicare Advantage plan, you can do so right away or during the Medicare Advantage and Prescription Drug Plan Annual Enrollment Period (Oct. 15 to Dec. 7) in any year.

- Original Medicare consists of Parts A and B, and you generally pay a percentage of services, regardless of where you live. You can go to any doctor, hospital, or provider that is contracted with Medicare anywhere in the country. You can add Part D prescription drug coverage by enrolling in a private “stand-alone” prescription drug plan for an additional premium. You can buy separate Medicare supplement insurance (See “Where Can I Get Help?”) to cover some or most of the out-of-pocket costs of Parts A and B.

- Medicare Advantage (MA) offers an alternative way of receiving your benefits through local or regional private plans, which are often health maintenance organizations (HMOs) or preferred provider organizations (PPOs). Each plan must include everything covered by Original Medicare, but may offer more benefits and/or lower copays. Most plans charge a monthly premium (in addition to the Part B premium), and many include Part D prescription drug coverage. Your choice of doctors and other providers may be restricted to those in the plan’s network. Each plan can, each calendar year, change its premiums, its extra benefits, and its copays, or withdraw from Medicare.

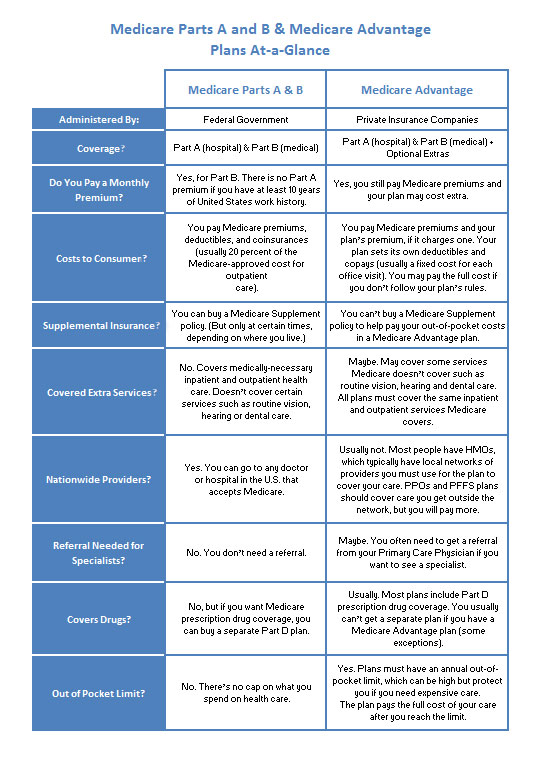

Click on the Comparison Chart (left), to make it bigger.

How do I choose a Medicare Advantage plan?

Almost everyone in Medicare has access to at least one MA plan, and in many areas, there are dozens, each with its own mix of costs, benefits and conditions. Your mailbox may be stuffed with their ads. But to compare plans objectively and free of sales pressure, use the official Medicare website, www.medicare.gov, which lists details of every plan in your area, including a measure of the quality of its care — or call the Medicare helpline for assistance (1-800-MEDICARE), open 24 hours a day including weekends. You can enroll in the plan you choose through Medicare or directly through the insurance company.

How do I choose a Part D plan?

If you need to add prescription drug coverage to Original Medicare, you also will be faced with dozens of different plans. You can compare these in the same way you compare Medicare Advantage plans. If you don’t currently take any drugs, you may want to choose the plan with the lowest premium to get coverage at the least cost. Otherwise, it’s best to choose a plan according to the specific drugs you take, because plans charge widely varying copays even for the same drug. The plan finder on the Medicare.gov website automatically does the math to find your best deal. You can enroll through Medicare.gov or directly with the plan. If you do not enroll in a Medicare Part D prescription drug plan within 63 days after your initial enrollment period ends, you may be charged a penalty. See penalty details at https://www.medicare.gov/part-d/costs/penalty/part-d-late-enrollment-penalty.html

What if I change my mind?

You will not be locked into any plan permanently. You can switch between the different options at certain times of the year or in specific circumstances. For full details, see related article“Enrollment Oppotunities.”

Why is Medicare so intricate?

The program has separate rules for people in different situations and a range of choices that require everyone to make personal and timely enrollment decisions. From time to time over Medicare’s 45-year history, Congress has added more benefits and options, each with its own new set of rules. Although every piece has an inner logic, Medicare has become quite intricate. However, it gives the comfort of guaranteed health coverage to more than 50 million Americans. (CMS – Centers for Medicare & Medicaid Services, 7/28/2015, page 1, https://www.cms.gov/Newsroom/MediaReleaseDatabase/Press-releases/2015-Press-releases-items/2015-07-28.html)

GET HELP FROM A LICENSED SALES AGENT NOW

Out-of-network/non-contracted providers are under no obligation to treat Plan members, except in emergency situations. Please call the Plan’s customer service number or see your Evidence of Coverage for more information, including the cost-sharing that applies to out-of-network services.